You’ll typically need about $1,600–$2,400 per month to live comfortably in Irving. Average rent for a ~716 sq ft apartment is near $1,316 (about 19% below the U.S. average), with studios ~$1,294, one‑beds ~$1,316, and two‑beds ~$1,697. Add utilities, internet, phone and renters insurance of roughly $325–$570 monthly. Neighborhoods and amenities drive price swings, and the rest of this guide breaks down specifics and budgeting tips.

Overview of Irving’s Rental Market in 2025

Although Irving’s rental market stayed relatively stable in 2025, you’ll find rents that are markedly cheaper than the national norm.

Though Irving’s rental market stayed steady in 2025, rents remained noticeably below the national average.

You’ll see the average rent in Irving at about $1,316/month for a typical 716 sq ft unit, roughly 19% below the national average of $1,629.

Supply is broad—9,284 apartments were listed in October 2025—so you can target options from budget to premium.

Year‑over‑year change is modest (+0.7%, ≈$10/month), and some neighborhoods showed slight month‑to‑month easing, which can aid timing your search.

Unit-size differences matter: studios near $1,294, one‑beds $1,316, two‑beds $1,697, and three‑beds $2,086+.

If you’re prioritizing cost, focus on affordable neighborhoods such as Las Brisas Hills, Hardrock Estates, and Mandalay Place; expect higher rents in Fairway Vista, Urban Center Irving, and La Villita.

Use this data to set realistic budget targets and compare listings to the national average. Additionally, considering the costs for building a home in nearby areas can provide insights into long-term housing options.

Current Average Rent and How It’s Changed

You’re paying an average of about $1,316/month for a 716 sq ft apartment in Irving, up roughly 0.7% year‑over‑year (about $10/month).

Look at unit-size gaps too: studios run about $1,294, one‑beds $1,316, two‑beds $1,697 and three‑beds $2,086+, which shows a steep jump for multi‑bed units.

Use these trends alongside supply data (9,284 listed units) to assess whether rents are likely to keep edging up or level off. Additionally, keep in mind that repair costs can impact overall living expenses, especially for families with children in school.

Average Rent Trend

Because rent changes have been modest overall, you’ll find Irving’s market sitting near $1,316 per month on average — about $10 higher than a year ago (a 0.7% increase) — even though short‑term swings have shown a month‑to‑month dip of roughly $15 and occasional reports of a $50 year‑over‑year decline.

You’ll see this average rent sit below the national mean by roughly 19%, reflecting a more affordable metro option.

Market Trends in Irving show stability with localized variation: studios average $1,294, one‑beds $1,316, two‑beds $1,697 and larger units jump to $2,086+.

Your choice of neighborhoods in Irving matters — Garden Oaks and Irving Heights trend around $1,268, while Las Colinas pushes medians near $2,091.

Unit-Size Price Gaps

When you break Irving’s market down by unit size, the gaps are clear and have only shifted modestly over the past year: the overall average apartment rent sits at about $1,316/month (roughly 716 sq ft) — up about $10, or 0.7% year‑over‑year — while studios and one‑beds cluster near $1,294–$1,316, two‑beds jump to roughly $1,697, and three‑bed units top out around $2,086+.

You’ll see variation across sources: some report a citywide average near $1,519 and two‑bedroom apartment averages close to $1,795; house rents and median rent figures run higher, often $2,350–$2,800.

Recent short‑term data show slight easing, so the average cost by unit can dip month‑to‑month. Use these ranges when setting your budget.

- It’s manageable if you plan.

- Expect tradeoffs for space.

- Watch trends before signing.

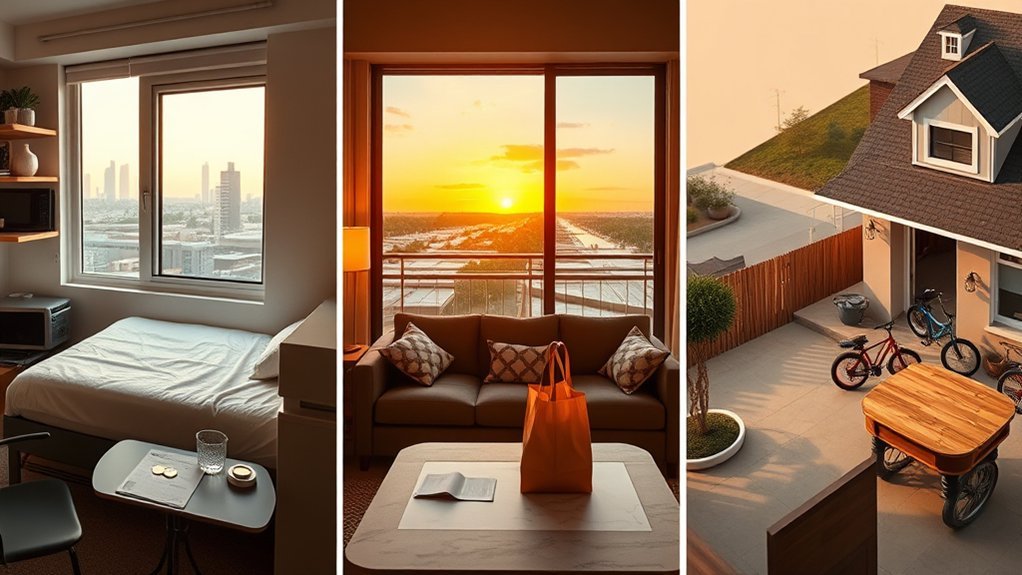

Rent by Property Type: Studios, Apartments, and Houses

Compare unit types to see how much space and cost matter in Irving: studios average about $1,294/month, one‑beds roughly $1,316, two‑beds about $1,697, and three‑beds climb to around $2,086+. When you weigh Irving Rental options, average prices show apartments sit near $1,519 citywide, with some reports putting one‑beds between $1,328–$1,375 and two‑beds around $1,795. That means you’ll often pay a modest premium for extra bedrooms but a larger jump moving from apartments to houses.

If you’re budgeting, expect houses to command higher rent prices — commonly $2,400–$2,800 depending on size and condition. Average apartment size is about 716 sq ft, so compare per‑square‑foot costs if space matters. Also note the citywide average rent of $1,316 is roughly 19% below the U.S. average, so Irving can be economical if you choose the right property type and size for your needs. Additionally, it’s crucial to consider financing options when planning your overall budget for living expenses.

Neighborhood Rent Guide: Most Affordable to Most Expensive

Start by mapping Irving’s neighborhoods from most affordable to most expensive so you can target areas that match your budget and priorities. Use current CoStar Group data to guide choices: most affordable neighborhoods include Las Brisas Hills, Hardrock Estates, and Mandalay Place with rents below the city average; highest-cost areas are Fairway Vista, Urban Center Irving, and La Villita with rents well above average.

Las Colinas is upscale with a median rent around $2,091, while affordable rental options like Garden Oaks, Irving Heights, and Oak Park average about $1,268. Understanding repair costs can help you budget better for unexpected expenses.

Decide what you value—proximity to work, amenities, or lower rent—and weigh trade-offs. Note where listings concentrate: Las Colinas, Valley Ranch, and Urban Center Irving offer the largest selection, so you’ll find choices across price points and unit types.

Revisit quarterly data to adjust your search and prioritize neighborhoods that meet your financial and lifestyle goals.

- Choose stability.

- Seek options.

- Balance cost and commute.

Monthly Essentials: Utilities, Internet, and Insurance Costs

Although rent is the biggest line item, you should budget for utilities, internet, phone, and insurance because they add meaningful monthly cost: expect about $239 for energy, an extra 15% on other utilities versus the U.S. average, roughly $225 for a phone plan, $50–$80 for mid‑range internet, and $10–$25 for basic renters insurance — together these commonly add $325–$570 to your monthly housing expenses beyond the $1,316 median rent, so plan household income and savings accordingly.

You’ll want to treat utilities and Internet as predictable recurring costs: energy (~$239) plus higher local utility rates push the subtotal up, while a typical phone bill (~$225) dominates communications. Pick an internet tier that matches work and streaming needs; $50–$80 covers most mid‑range plans. Don’t skip renters insurance — $10–$25 stabilizes risk and often satisfies lease requirements. Additionally, it’s important to consider operating expenses when planning your overall budget for housing and living costs.

Add these to your budget early, and adjust savings targets so housing, utilities, Internet, phone, and insurance together stay within a sustainable share of your monthly income.

Grocery, Food, and Healthcare Expenses in Irving

You’ll find grocery prices in Irving roughly 1% below the national average, with basics like bread at $3.90, milk $4.64, and eggs $3.52, and dining options such as a hamburger averaging $5.60.

Factor in household energy costs (about $238.92/month) when estimating food storage and cooking expenses.

On healthcare, expect costs about 3% above the national average—typical visits run around $150 for a doctor, $122.51 for a dentist, $136.04 for an optometrist, with prescriptions averaging $21.44 and routine vet visits about $74.13. Additionally, understanding replacement costs for essential home systems, like air conditioning, can help you budget effectively for unexpected repairs.

Grocery Price Breakdown

When you budget for groceries in Irving, expect prices to be roughly in line with the national average—about 1% lower overall—with staples like a loaf of bread at $3.90, a gallon of milk at $4.64, eggs around $3.52 per carton, and bananas about $0.73 per bunch. You’ll find irving groceries generally affordable; grocery prices support a reasonable Cost of Living estimate and let you plan predictable weekly spends.

Dining out remains moderate — a hamburger near $5.60 — so mix meals smartly to control costs. Track unit prices, seasonal produce, and sale cycles to stretch your food budget. Practical planning reduces surprises and keeps your monthly essentials within target.

- Relief — small savings add up.

- Control — predictable budgeting.

- Confidence — clear cost data.

Healthcare Costs Overview

Because healthcare costs in Irving run about 3% above the national average, factor medical expenses into your monthly budget alongside groceries and utilities.

You can expect an average doctor visit of $150.08 and dentist care around $122.51, plus routine optometrist checks near $136.04.

Prescription drugs average $21.44 per prescription, and pet veterinary visits run about $74.13.

Combine these to estimate a realistic healthcare Cost per month: if you budget one doctor visit, one prescription, and routine eye care quarterly, plan roughly $200–$300 monthly for personal medical needs, with additional buffer for dental or unexpected care.

Include pet healthcare separately.

Track actual bills to refine your per month projection and avoid surprises.

Transportation and Commuting Costs

Get a realistic picture of transportation costs in Irving before you sign a lease: on average they run about 9% below the national norm, thanks to cheaper local transit and lower driving expenses.

Expect transportation costs in Irving to be roughly 9% below national averages, easing commuting expenses.

You’ll see transportation expenses tilt toward savings—fuel averages about $2.95/gal, and DART/Irving connections reduce last‑mile burdens.

Factor in parking, maintenance, and occasional longer commutes if your job isn’t near Las Colinas.

- You’ll feel relief when monthly fuel and transit passes cost less than many metro areas, lowering your overall commuting costs.

- You’ll worry less about day‑to‑day expenses if your employer offers transit benefits or you use nearby rail and bus routes.

- You’ll appreciate shorter average commutes from Irving’s central locations, which cut wear, time, and parking fees.

Additionally, be mindful of potential vehicle-related expenses, including exhaust leak repairs, which can impact your overall transportation budget.

Use C2ER-based savings on transit and fuel to offset higher utilities; plan for parking and maintenance to avoid surprise costs.

Suggested Income and Budgeting for Irving Renters

Although Irving’s average rent of $1,316/month looks manageable on paper, you should plan to earn about $4,386 per month ($52,632/year) to keep housing costs near the 30% rule, and then add utilities and cushions for a realistic monthly budget.

You’ll also factor energy costs averaging about $238.92/month for a typical 716 sq ft apartment, plus communications and extras; utilities run roughly 15% above the national average, so add a $200–$300 monthly cushion.

If you want a larger unit, expect 2-bedroom rents near $1,697 or houses around $2,400–$2,800, so target proportionally higher income.

Don’t forget recurring costs—transportation tends to be ~9% below national average and groceries about 1% below—when evaluating overall affordability.

Use a rent affordability calculator to model your exact situation, include utilities and cushions, and adjust gross income targets until your housing and essential expenses fit comfortably within your monthly budget.

Additionally, considering potential air conditioning maintenance costs is important, especially during hot summer months, as they can impact your overall budget.

Factors That Drive Rent and Cost-of-Living in Irving

When you assess Irving’s cost of living, focus first on housing supply and demand—limited higher-quality units in desirable areas push averages toward the $1,316–$1,453/month range and spike Las Colinas medians near $2,091.

Local wage levels matter too, since the 30%-of-income affordability rule implies you’d need roughly $52,632/year to comfortably cover the citywide average rent before other bills.

Finally, amenities and location premiums—proximity to transit, shopping, or higher-rated neighborhoods—create consistent rent differentials across areas like Fairway Vista versus Las Brisas Hills. Additionally, understanding budget considerations can help residents make informed financial decisions when navigating living expenses in the area.

Housing Supply and Demand

Supply and demand in Irving’s rental market are steering rent trends more than any single policy change: about 9,284 apartments were listed in October 2025 (CoStar), giving renters more choice and easing upward pressure on prices.

You’ll find average rental prices near $1,316/month — roughly 19% below the national average — so Living costs tied to housing supply stay comparatively moderate.

Neighborhood variation matters: Las Colinas and Valley Ranch offer more inventory, while Fairway Vista and La Villita keep rents high.

Utilities and transportation costs interact with housing to shape total expenses.

Recent data show slight easing — ~+0.7% year‑over‑year and some monthly dips — signaling softer demand versus supply.

- Relief — more options lower stress.

- Caution — pockets still expensive.

- Opportunity — negotiate or wait.

Local Wage Levels

Compare your paycheck to Irving’s costs: to comfortably cover the average $1,316 rent using the 30% rule you’d need about $4,386 a month. That target shows how local wage levels drive affordability: many jobs must pay at or above that to prevent housing stress.

Average rent in Irving sits about 19% below the national average, so wage requirements are lower than in pricier cities, but neighborhood spread (Las Colinas ≈ $2,091 vs. ~$1,268 elsewhere) creates varying thresholds.

Median home price near $483,795 pushes up wage needs for buyers and for sectors like construction and real estate.

Don’t forget utility costs run ~15% higher than national average (~$239/month), so take-home pay must cover both rent and elevated utilities when you assess local wages.

Amenities and Location Premiums

Beyond wages and monthly bills, location and on-site amenities directly shape what you’ll pay for housing in Irving. You’ll notice proximity to premium neighborhoods like Las Colinas or Urban Center Irving can add several hundred dollars—Las Colinas median rent ≈ $2,091 vs. citywide apartments ~$1,316–$1,519. Luxury amenities (pools, gyms, gated access) and new construction push 2-bed rents toward ~$1,697 and houses into $2,400–$2,800.

Transportation access and walkability near business centers or transit corridors shorten commutes but raise rents. Utilities run about 15% above national averages; energy averages ~$238.92/month, so factor those into monthly cost. Consider school quality, shopping, and green space—family-friendly areas command premiums even if overall Irving stays relatively affordable.

- You’ll feel the premium.

- You’ll pay for convenience.

- You’ll weigh amenities vs. cost.

Resources for Finding Rentals and Managing Your Budget

Start by narrowing down searches on major listing sites—Apartments.com, Zillow, HotPads, RentCafe and Realtor.com—so you can quickly filter by price, bedrooms, pet policies and virtual tours; Apartments.com also provides tenant screening and online rent payment tools that speed move-in and ongoing management.

Use those filters to find affordable units within Irving’s Rental Market — average rent is about $1,316/month (avg. apt ~716 sq ft).

Target neighborhoods by budget: Las Brisas Hills, Hardrock Estates and Mandalay Place for lower-cost options; Fairway Vista and Urban Center Irving if you can pay a premium.

Build a 30%-of-income rule into your plan (financial advisers recommend earning ~$4,386/month to keep rent affordable).

Add utilities (energy ~$239/month, phone ~$225/month; utilities ~15% above U.S. avg.~15% above U.S. avg. and transport (about 9% below U.S. avg.).

Prepare documents—photo ID, pay stubs, rental refs—for faster approval.

Use spreadsheets or budgeting apps to track rent, utilities and savings so listings and expenses align. Additionally, understanding retainer replacement costs can help you manage unexpected expenses in your budgeting plan.

Frequently Asked Questions

What Is the Cost of Living in Irving, TX?

The cost of living in Irving, TX is moderate: you’ll pay about $1,316–1,453 monthly rent, higher utilities near $239, groceries slightly below average, healthcare a bit higher; consider commute patterns, school ratings, and local cuisine when budgeting.

What Is the Average Cost of Living per Month in Texas?

You’ll typically spend about $3,000–$4,500 monthly in Texas, depending on location; consider utility assistance in high‑energy areas, rural comparison shows lower housing but higher transport, and tax impact on overall disposable income.

How Much Should Rent Cost per Month?

Want to pay smart, not too much? You should target rent at or below 30% of gross income (about $4,386/month needed for $1,316 rent). Watch market trends, understand landlord rights and formalize roommate agreements.

Is Irving, TX a Good Place to Live?

Yes — you’ll find Irving livable: community events are active, school ratings vary but include solid options, commuting options are good with highways and transit, and data shows housing costs are generally competitive versus national averages.

Conclusion

You’ve got a grounded grasp of Irving’s rent reality — rising rents, varied neighborhoods, and steady essentials — so plan proactively. Prioritize precise budgeting, pursue practical savings (roommates, efficient utilities, bundled services), and probe plentiful resources for rentals and renter’s insurance. Balance commute costs against cheaper rents, and keep income targets in mind to maintain margin. Stay flexible, track trends, and use data-driven decisions to secure sensible, stable housing in Irving’s shifting market.