You’ll typically need between 3,000 and 12,000 GHS monthly to live comfortably in Ghana, depending on choices. If you pick low-end shared housing and local markets, costs sit near the bottom; mid-range flats, private schools, and regular dining push you higher. Utilities, fuel and internet can add hundreds of cedis, while international-school fees and high-end rent drive expenses into the top bracket. Keep going and you’ll find a detailed breakdown to help plan your budget.

Housing and Rent in Accra and Beyond

Although neighborhood and amenities drive large price gaps, you can expect low-end rent in Accra to run around 500 Ghana cedis per month—often with shared facilities—while mid-range units typically cost 2,500–5,000 cedis and usually include backup water and power. High-end properties climb to about $2,000–$5,000 monthly with services like cleaners and security.

Note that landlords commonly ask for significant upfront payments (six months or more for upscale units, one to two years for cheaper ones), so location plus payment terms are key factors when comparing options across the greater Accra region.

You’ll find housing and rent choices that reflect this spread: student-style rooms or shared apartments at the low end, purpose-built flats with reliability at mid-range, and serviced compounds at the top.

When you evaluate cost to live, compare neighborhoods because prices vary widely between suburbs, business districts, and gated communities. Factor in lease length and upfront demands—those payment norms materially shift monthly affordability and your effective annual housing cost.

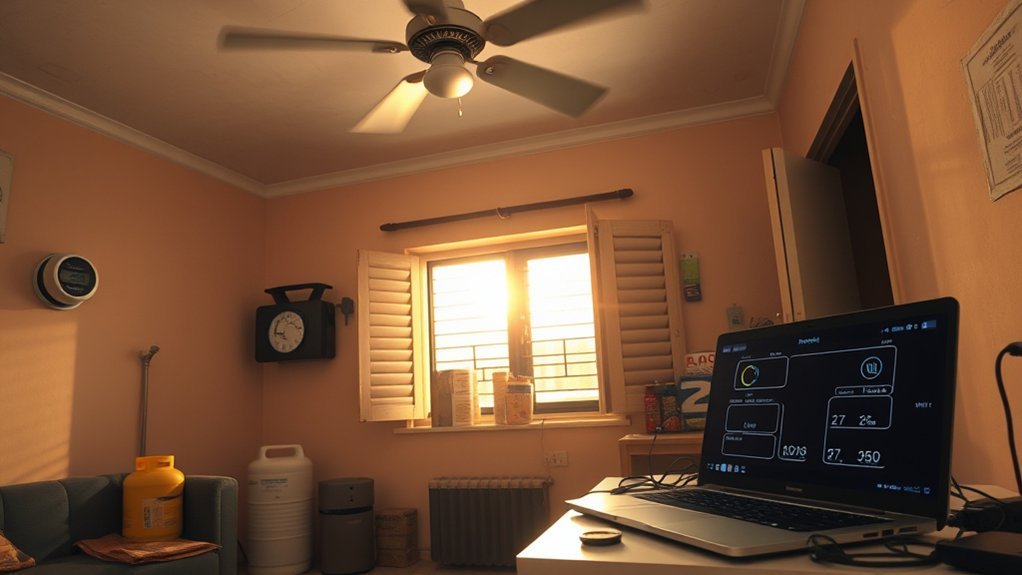

Monthly Utilities and Internet Costs

After you’ve sized up housing costs and upfront payment demands, monthly utilities materially change your effective rent-to-income ratio and can push a modest budget higher. You’ll typically pay about 250 Ghana cedis for water and 100 cedis for mobile credit per month; electricity varies — roughly 500 cedis every three weeks with light AC, rising to ~1,000 cedis per month with heavy use. Newer broadband plans (MTN, etc.) run 700–800 cedis per month. Overall utility expenses depend on household size and behavior, so compare single-person versus family scenarios when budgeting.

| Utility | Typical cost (GHS) | Frequency |

|---|---|---|

| Water | 250 | per month |

| Electricity | 500–1,000 | 3 weeks–per month |

| Broadband | 700–800 | per month |

Contextually, these monthly utilities can rival local public transport costs when aggregated, affecting disposable income and choices about where you live.

Schooling and Education Expenses

When planning schooling costs in Ghana, you’ll note government schools charge no tuition for residents though they may have small study fees.

Medium-end private schools typically ask 5,000–8,000 Ghana cedis per term.

International schools start around $2,000 per semester, so expatriate families often face substantially higher bills.

Also budget separately for extras like books, extracurriculars and excursions, and consider that overseas children may find government schools harder to adjust to than medium-end private options.

Public Vs Private Costs

Though public schools in Ghana don’t charge tuition for local residents, you’ll still encounter modest study fees and ancillary expenses.

Private options range from medium-end local schools charging roughly 5,000–8,000 Ghana cedis per term to international schools starting near $2,000 per semester. Beyond base tuition, private schooling adds costs for books, extracurriculars and excursions. Expatriate children may struggle to adapt in government schools, whereas medium private high schools are generally more manageable financially and culturally.

You should weigh Cost of Living trade-offs: public schooling lowers recurring tuition outlay but may require supplementary transport or tutoring, and private schooling raises monthly household education spending.

Factor in public transportation needs, materials, and activity fees when budgeting for schooling choices.

International School Fees

If you’re budgeting for schooling in Ghana, expect international-school tuition to start around $2,000 per semester for expatriate and foreign students.

Mid‑range private schools like Ridge and Christ the King charge roughly 5,000–8,000 Ghana cedis per term. On top of base fees, plan for extra costs for books, extracurriculars and excursions that can add several hundred dollars (or equivalent cedis) a year.

You’ll compare international school fees against free government schooling for Ghanaian residents — government schools have no tuition but may require modest material payments.

If you’re bringing overseas children, note adjustment challenges in public schools; medium-end private schools balance cost and quality and typically offer more supportive environments.

Factor currency variation and term structures when projecting annual tuition.

Additional School Expenses

Beyond base tuition, you’ll need to budget for a predictable set of add‑ons that can substantially change annual schooling costs.

Government institutions may waive tuition fees for residents, but expect minimal study fees and routine expenses. Medium-end private schools (e.g., Ridge, Christ the King) charge 5,000–8,000 GHS per term; international schools start near $2,000 per semester, so additional costs for schooling magnify total outlay.

- Books and uniforms: recurring, often termly.

- Extracurricular activities: sports, music, clubs billed separately.

- Excursions and lab fees: occasional but potentially costly.

- Transport and meals: daily operational costs that add up.

Compare options: international schools cost substantially more overall, while private locals balance adaptation and predictable additional fees.

Transportation, Fuel, and Healthcare Costs

You’ll find fuel at about 16.23 GHS per liter, which typically translates to roughly 800 GHS monthly for a medium-sized car, so factor that into your transport budget.

For many trips, tro-tros are the cheapest option while taxis and Uber (short fares ≈ 20 GHS) offer comparable convenience at higher cost.

On health, NHIS cardholders get free care at government hospitals but private admission fees range from 70–100 GHS at lower-end clinics to 300+ GHS at premium facilities, and follow-up costs vary widely depending on the facility and condition.

Fuel Prices and Budget

While fuel sits at about 16.23 GHS per liter, its ripple effect on your monthly transport budget is clear: a medium-sized car owner typically spends roughly 800 GHS a month on fuel, though actual costs vary with usage and routes.

You’ll compare that to alternatives when planning transportation costs and health services access. Consider these practical points:

- Fuel prices directly drive personal-car budgets; longer commutes push monthly spend above 800 GHS.

- Ride-hailing (Uber) is competitively priced; typical taxi fares for short trips average ~20 GHS, only ~2 GHS more than Uber.

- If you reduce driving and use shared options, you can cut fuel-related expenses by a notable margin.

- Factor healthcare: NHIS cardholders get free care at government hospitals; private admissions run 70–300+ GHS, affecting disposable transport budget.

Public Transport Options

Having looked at how fuel costs and healthcare payments shape your monthly outgoings, consider how public transport can change that equation:

tro-tros offer the lowest fares for routine trips, taxis average about 20 GHS for short rides, and Uber typically undercuts traditional taxis by roughly 2 GHS while giving door-to-door convenience.

You’ll find tro-tros keep urban commuting cheap compared with the ~800 GHS monthly fuel bill for a medium car.

Taxis and ride-hailing add flexibility but can be quite expensive if you rely on them daily.

Uber’s slight discount versus taxis may not offset frequent trips.

Compare frequency, time savings, and AC use: driving raises fuel costs substantially.

For group travel or luggage, taxis/Uber win; for budget travel, tro-tros dominate.

please contact system

Healthcare Access Costs

Because travel and facility choice both shape your bill, compare transport modes, fuel needs, and hospital fees when estimating healthcare access costs in Ghana.

You’ll weigh fuel, taxis, and facility charges against benefits like NHIS coverage. Fuel is about 16.23 GHS/liter; a medium car costs ~800 GHS/month. Short taxi rides average 20 GHS, and ride-hailing is comparable.

NHIS cardholders can access government hospitals for free, so access government hospitals if eligible to cut costs on healthcare services.

- Private admission: 70–100 GHS at lower-end facilities

- Higher-end private admission: 300+ GHS

- Monthly personal fuel: ~800 GHS for a medium car

- Follow-up health service costs: highly variable by facility and condition

Compare options to minimize out-of-pocket spending.

Food, Groceries, and Dining Out

Curious how far your food budget will go in Ghana? You’ll find food,groceries,dining out costs vary by location and style. Shopping at local markets can cover a single person’s groceries for about $30 monthly; supermarkets like Shoprite often charge roughly double. Local restaurant meals run ~200 GHS, while high-end dining approaches 500 GHS. Nightlife and low-end entertainment dining nights cost around 300 GHS; mid-range nights can reach 1,000 GHS.

| Item | Typical Cost |

|---|---|

| Local market monthly groceries | $30 |

| Supermarket monthly groceries | ~$60 |

| Local restaurant meal | 200 GHS |

| High-end restaurant meal | 500 GHS |

| Night out (low vs medium) | 300 vs 1,000 GHS |

Context matters: choosing markets over supermarkets cuts grocery bills substantially. If you dine out frequently you should budget for 200–500 GHS per meal, and factor occasional 300–1,000 GHS nights out into discretionary spending.

Leisure, Fitness, and Entertainment Spending

Food and nightlife choices shape more than your grocery bill; they also set the baseline for your leisure and fitness spending. You’ll see a clear tiered pattern: low-end entertainment venues like bars cost about 300 Ghana Cedis per night, medium venues ~1,000 GHS, and high-end options 2,000–3,000 GHS.

Dining sits between market shopping (~$30 per trip) and restaurant meals (200–500 GHS).

You can optimize costs by mixing options and prioritizing activities that match your budget and goals:

- Choose low-end entertainment venues for frequent nights out (~300 GHS) and reserve high-end experiences for special occasions (2,000–3,000 GHS).

- Use local outdoor gyms at 100–200 GHS/month for basic conditioning versus high-end AC gyms at 1,500–2,500 GHS.

- Take tennis lessons for focused fitness at about 400 GHS/month if you want skill development and cardio.

- Balance dining and entertainment: cheaper grocery trips let you afford occasional mid-range nights out.

Frequently Asked Questions

How Far Does $100 Go in Ghana?

You’ll stretch $100 for local purchasing: it covers about three grocery shops, 10–20 local meals, or ~500 short taxi rides. For cost of living control, budget tips include prioritizing markets, shared rent, and modest dining.

Can US Citizens Live in Ghana?

Yes — you can live in Ghana: follow visa requirements for tourist, business or residence permits, compare housing options across cities, and prepare for cultural adaptation using data-driven, contextual planning to decide length and costs.

How Much Is a Gallon of Milk in Ghana?

You’ll pay about 25–30 GHS per gallon of milk — milk prices vary by region; local supermarkets often charge more than markets. Comparing dairy products, powdered options cut costs, so you’ll choose based on access and budget.

How Much Money Do You Need to Earn to Live Comfortably in Ghana?

You’ll need an average salary of about 2,500–5,000 Ghana cedis monthly to live comfortably; cost essentials like rent, utilities, food and transport vary by lifestyle choices, so compare neighborhoods and spending to balance budget.

Conclusion

Moving to Ghana is like steering through a river where costs are the current: rent in Accra pulls stronger, utilities and international school fees create rapids, while local markets and public transport offer calmer, cheaper eddies. Compared to many capitals, you’ll find clear trade-offs — higher housing and private healthcare versus affordable food and commuting. Use data, budget for the big flows, and you’ll guide confidently through daily life, balancing comfort with cost.