You’ll generally need $500–$1,000 monthly for basic urban living and $1,500–$3,500 for a comfortable expat lifestyle in the Republic of the Congo. Rent dominates costs: inner‑city one‑bedrooms run about $600–$1,500, outside centers $300–$800. Expect utilities $100–$300, internet $50–$200, modest groceries and transit low relative to developed markets but sensitive to inflation and imports. Salaries and purchasing power are limited, and the following sections break down specifics and tradeoffs.

Overview of Living Costs and Economic Context

Because costs swing sharply between cities and countryside, you’ll see very different budgets depending on location: urban residents typically pay higher rents, food, and transport than those in rural areas.

You should expect the Cost of Living to reflect that split: an urban basic budget runs roughly $500–$1,000 monthly, while a comfortable expat Monthly Cost lands near $1,500–$3,500.

Utilities and internet add measurable overhead — electricity, water, and garbage often total $100–$300 per month, and high-speed internet is typically $50–$200.

Food shows similar variance; local markets lower your bill compared with supermarkets (milk ~$2–$3/L, beef ~$8–$15/kg).

High inflation and weak infrastructure push volatility into these line items, so your Monthly Cost can spike with supply disruptions or currency shifts.

When you plan, compare urban versus rural line items explicitly and stress-test budgets for utility and food inflation to gauge realistic living-cost scenarios.

Housing Costs Across Cities and Rural Areas

You’ll notice clear urban rental variations: city-center one-bedrooms typically run $600–$1,500 while outside-center units drop to $300–$800, and three-bedrooms in central areas rise to $1,500–$3,000.

Renting directly from private landlords often cuts costs compared with agencies, which matters when you compare urban demand-driven prices to lower rural rates.

To evaluate affordability you should weigh these price brackets against local economic conditions and available land options in rural areas.

Urban Rental Variations

While urban rents in the Republic of the Congo vary by neighborhood and amenities, city-center 1‑bedroom apartments typically command $600–$1,500 per month compared with $300–$800 outside center.

3‑bed units in central areas jump to $1,500–$3,000, reflecting a clear urban premium. You’ll notice the cost gap aligns with service levels, access to utilities and proximity to jobs.

Compare central listings to peripheral ones: central units price for convenience and finished standards; outside-center units trade lower rent for longer commutes and fewer managed services.

Renting directly from private landlords often reduces monthly outlay versus agencies, so you can save on fees if you negotiate.

Use these comparative ranges to budget realistically for urban versus noncentral living.

Rural Land Affordability

Although land and housing are generally cheaper outside major Congolese cities, affordability varies widely by local conditions: city-center 1‑bedroom rents run $600–$1,500/month versus $300–$800 outside centers, and rural plots often cost less still but reflect trade-offs in infrastructure and services.

You’ll find rural land prices tied to agricultural productivity and access: fertile, well-connected plots command premiums, while remote parcels are cheaper but have limited roads, water, and electricity.

Given a minimum wage near 172,630 XAF (~€57), many rural households earn below market thresholds, constraining choices and pushing reliance on family farming and self-built housing.

Comparative analysis suggests rural affordability improves nominally, but real affordability depends on transport costs, service access, and income stability.

Utilities, Internet, and Household Services

Expect monthly utility bills of roughly $100–$300, but plan for frequent outages that make generators or UPS systems a common extra expense.

High-speed home internet runs about $50–$200 per month in cities, while mobile data (10GB) costs just $10–$30 and can be a cost-effective alternative.

Compare total household spending on electricity plus backup power to connectivity choices to judge trade-offs between reliability and monthly outlay.

Electricity and Backup Power

How much will you pay to keep the lights on? You’ll see electricity prices push monthly utilities to $100–$300; unreliable grid supply forces comparisons between paying higher bills or buying backup generators. Many households compare generator purchase plus fuel to recurring outages’ indirect costs. Data show urban residents often pay more for consistency; rural areas rely on small generators or battery systems. Assess expected uptime, fuel expenditure, and maintenance when estimating total cost.

| Item | Typical monthly/equivalent cost |

|---|---|

| Grid-influenced utilities | $100–$300 |

| High-speed internet (urban) | $50–$200 |

| Mobile data (10GB) | $10–$30 |

| Backup generator fuel/maintenance | varies; significant |

| Generator purchase (one-time) | varies; substantial |

Internet and Mobile Connectivity

Because reliable connectivity often determines whether you can work or run a business in the Republic of the Congo, expect to pay a premium for high-speed internet—roughly $50–$200 monthly—while mobile data offers a cheaper alternative at $10–$30 for 10GB.

Urban households typically spend more to secure consistent service, and many factor in generator fuel or battery costs when comparing total monthly connectivity expenses. You’ll assess internet access against overall utilities ($100–$300/month) and backup-power spending.

If you need stable upload/download speeds for remote work, higher-tier fixed services—despite cost—are often cheaper than frequent mobile tethering. For casual browsing or backups, mobile data plans provide flexibility and lower monthly outlay.

Compare providers’ uptime, speeds, and bundled backup options before committing.

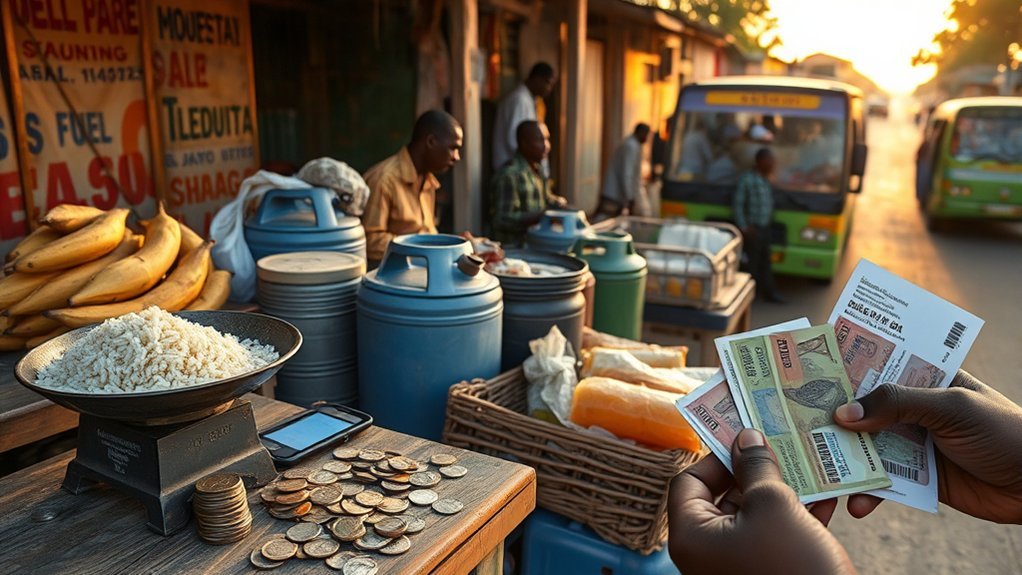

Food, Groceries, and Eating Out

While prices vary across markets and neighborhoods, you’ll typically pay about $1.50–$2.50 per liter for milk and $1–$2 per kilogram for rice, with a dozen eggs costing roughly $2–$4. You’ll find food and groceries are cost-competitive if you favor local markets: fresh produce is noticeably cheaper than supermarkets. Beef is a high-variance item at $8–$15/kg, so dietary choices drive your monthly bill.

| Item | Typical Price |

|---|---|

| Milk (1 L) | $1.50–$2.50 |

| Rice (1 kg) | $1–$2 |

| Eggs (dozen) | $2–$4 |

| Beef (1 kg) | $8–$15 |

| Local meal | $5–$15 |

Eating out is affordable for local cuisine; international restaurants increase costs. Compare weekly market shopping against supermarket baskets to estimate savings: choosing markets and seasonal produce lowers monthly grocery spend considerably, while frequent dining at international venues raises it.

Transportation and Mobility Expenses

Many residents and expats weigh public transit against private options when budgeting for mobility, since shared taxis and minibuses cost about $0.50–$2 per short trip while intra-city taxi rides run $5–$15.

You’ll compare per-trip costs to fixed costs: fuel at $1.50–$2.50 per liter, car rental at $800–$2,000/month, and variable maintenance and insurance.

If you commute daily, owning or renting a vehicle quickly surpasses aggregated public fares; a 20-workday month of $1 trips totals $40, versus several hundred dollars in rental fees or monthly fuel expenses.

Expatriates often opt for private vehicles for convenience and security, shifting their budget toward higher predictable costs.

For short-term stays, frequent taxi use can be economical; for long-term residency in the Republic of the Congo, calculate break-even points by comparing expected trip frequency, average taxi fares, and monthly rental or fuel-driven ownership costs to choose the most cost-effective mobility strategy.

Healthcare and Medical Services Costs

Expect to spend considerably more for reliable care in the Republic of the Congo, since public facilities are often underfunded and many residents turn to private providers for consistent services.

You’ll find a private doctor consultation typically costs $20–$50, while private hospital stays run $100–$300 per day, so acute episodes or overnight care can rapidly raise your monthly budget compared with many neighboring countries.

Private health insurance premiums range $100–$500 monthly; choosing coverage depends on your risk tolerance and whether you live in more expensive cities where private clinics cluster.

Vaccinations and preventative care are advisable given inconsistent public provision, and you should factor routine immunizations into annual health spending.

Many expats select international plans that include medical evacuation, which shifts large, unpredictable costs off local budgets.

In comparative, data-driven terms, reliable healthcare services here mean higher out-of-pocket and insurance expenses than in better-funded regional systems.

Education and Schooling Expenses for Families

Because public schools are often under-resourced, families—especially expatriates—tend to choose private or international options. This choice drives education costs from modest to substantial: local private schools typically charge $500–$3,000 per year, whereas international schools run $5,000–$25,000 annually. Additional expenses for supplies, uniforms, and activities potentially add several hundred dollars more per child.

Public schools are often under-resourced, so many families choose private or international schools, raising annual costs significantly.

You’ll evaluate trade-offs: private schools offer lower tuition fees but variable quality; international schools deliver curricula and facilities aligned with expatriate expectations at much higher cost. Employer education allowances can offset top-tier tuition fees, so factor benefits into net cost comparisons.

Estimate total annual education burden by adding base tuition, ancillary fees, and potential travel or boarding. Consider long-term budgeting: multi-child households see costs scale quickly, especially if all attend international schools. Use enrollment policies, student-teacher ratios, and accreditation status for comparative value assessment.

- Compare tuition fees vs. educational outcomes

- Include uniforms/supplies in budgets

- Check employer allowances

- Assess private schools’ accreditation

Typical Salaries, Minimum Wage, and Purchasing Power

After factoring education costs into household budgets, look next at earnings and what they actually buy: the statutory minimum wage is 60,000 XAF (about $100) per month, but enforcement is uneven and many informal workers earn under $50/month.

You should compare that floor to typical skilled salaries — roughly $200–$500 monthly — to gauge distribution. Quantitatively, a legally paid minimum wage places you near the poverty threshold, while skilled workers may reach 2–5x that level, depending on sector and expertise.

Yet purchasing power remains constrained: basic goods and services consume a large share of even mid-level incomes, and many households fall below subsistence benchmarks.

In practice, noncompliance in informal employment compresses income dispersion downward, reducing aggregate consumer demand. For planning, you’ll need to assume limited purchasing power for broad segments of the population and model scenarios where earnings are below statutory minimums, which materially alters feasible household spending and savings estimates.

How Local Economy and Inflation Affect Daily Costs

While oil revenues drive macro swings, you’ll see their effects at the market level: volatile inflation and a weak Congolese franc push up prices for imported staples and fuel, and limited transport infrastructure and supply chain bottlenecks add marked premiums to basic goods.

You face a cost of living that’s tightly coupled to oil price cycles; when global crude falls, government receipts shrink and import subsidies tighten, quickly translating into higher consumer prices. Measured inflation rates have spiked periodically, creating short-term real-wage losses and compressing purchasing power.

- Imported food and fuel are most sensitive to exchange-rate shifts and global oil volatility.

- Transport and logistics markups raise domestic prices even for locally produced goods.

- Households see sharp, uneven effects: urban consumers pay more for perishables; rural areas pay more for transport.

- Policy responses (subsidies, currency interventions) have temporary relief but often reintroduce volatility.

Comparatively, your budgeting must anticipate sudden inflation rate changes and plan buffers accordingly.

Frequently Asked Questions

Is It Expensive to Live in Congo?

It can be moderately expensive; you’ll pay $500–$1,000 for a budget lifestyle, $1,500–$3,500 for mid-range, rent and utilities drive costs, and healthcare or imported groceries can push your monthly expenses higher.

Is the US Friendly With Congo?

Yes — you’ll find the U.S. maintains diplomatic relations and cooperation with Congo, prioritizing stability, health aid, and governance reforms; however, ties are cautious, limited in trade and investment compared with stronger bilateral partners.

How Much Is a Bottle of Water in Congo?

A 1.5L bottle of water in Congo typically costs $0.50–$1.50; you’ll pay nearer $0.50 at local markets, higher in supermarkets, tourist areas or remote locations, so compare sources to minimize your per-liter cost.

What Is a Good Salary in Congo?

You’d want about $1,500 monthly to live comfortably; $200–$500 is average, while minimum wage is roughly $30. Oil, telecoms, NGOs pay $2,000–$5,000, showing stark urban–rural income disparities.

Conclusion

You’ll find costs in the Republic of the Congo vary sharply: rents in Brazzaville can be 4–6× higher than in rural towns, so housing drives budgets. Interesting stat: a local minimum wage of roughly $90–$120/month covers only about 20–30% of an urban basic basket, showing limited purchasing power. Compare utilities, transport and schooling against that baseline—expect inflation and oil-driven volatility to reshape expenses fast, so plan contingencies.