You can live in Panama comfortably for about $700–$2,500+ per month depending on location and lifestyle. Rent ranges from ~$300 outside Panama City to $600–$1,500 in the city; ocean-view condos start near $165,000. Groceries run $95–$350 monthly, meals $5–$40, and utilities $50–$100 (A/C can spike bills). Public transit is cheap, healthcare and insurance vary by plan, and residency/tax perks cut costs—keep going to see detailed breakdowns and saving tips.

Housing: Rent vs. Buying Across Panama

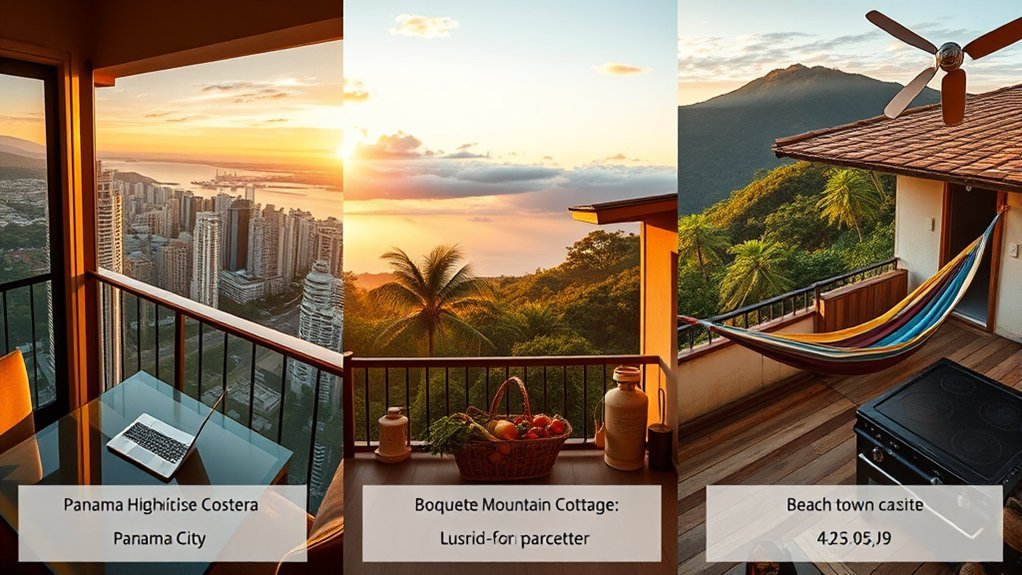

If you’re weighing rent versus buying in Panama, the numbers show clear trade-offs between city convenience and rural affordability.

You’ll find housing in Panama City pushes rent toward $600–$1,000 for one-bed apartments and $800–$1,500 for two-bed units, while ocean-view apartments and condos for buying often start around $165,000.

Outside Panama City the cost of living drops: one-bed rentals can begin near $300 per month, and buying becomes significantly cheaper.

Outside Panama City costs fall—one-bedroom rentals can start around $300/month, and property purchases become much more affordable.

In Coronado you can buy a 1,700-square-foot apartment for about $185,000, and Boquete offers three-bedroom homes around $150,000 with rentals from $800.

That means if you need proximity to services and amenities, expect higher rent or purchase prices in the city; if affordability is key, rural or resort areas give more buying power.

Use these benchmarks to compare monthly rent versus mortgage equivalents, factoring in property taxes, maintenance, and lifestyle needs before deciding.

Food and Grocery Costs: Local Markets to Supermarkets

When you shop in Panama, your monthly groceries will typically run between $95 and $350 depending on whether you buy mostly local produce or a lot of imported items.

Local markets can cut costs dramatically — a week’s worth of fruits and vegetables often costs about $20 — while a typical supermarket haul averages roughly $93.58 per week at chains like Rey.

You can stretch your budget by buying staples and produce at local markets and using supermarkets for packaged or imported goods.

Track monthly grocery expenses to see where imported items push you toward the upper range.

Dining out is affordable: expect $5–$10 for menu ejecutivo, $15–$20 at fast-casual spots, and $20–$40 at upscale restaurants if you want occasional meals out.

Use a mix of markets and supermarkets to balance cost, convenience, and variety.

- Buy seasonal produce at local markets

- Compare prices at supermarkets like Rey

- Plan weekly menus to control spending

- Limit imported items to reduce costs

- Mix dining out with home cooking

Transportation and Utilities: Getting Around and Monthly Bills

You’ll find getting around Panama is inexpensive whether you use public transit, ride-share, or drive your own car.

Metro and Metrobus rides typically cost $0.10–$1.50, Uber averages $3–$4, and monthly fuel for a personal vehicle is usually under $30 with insurance around $58.32 per month.

Utilities (electricity, water, gas) generally total $50–$100 monthly, though water alone is about $7.10 and electricity can spike with heavy A/C use.

Public Transit Affordability

How affordable is getting around Panama City? You’ll find public transportation highly affordable: metro fares are under $1 and buses cost about $0.25–$0.35 per ride. That keeps daily commuting costs low, and overall transport plus utilities stays budget-friendly.

- Metro system: efficient, fast, and cheap — great for daily commutes.

- Bus network: extensive routes with very low fares for short trips.

- Uber services: widely available and economical, typically $3–$4 per ride.

- Monthly gas expenses: under $30 for personal vehicles, reducing occasional car use costs.

- Utility bill impact: combined electricity, water, and gas runs $50–$100 monthly, so transit plus utilities remain affordable for most expats and locals.

Fuel and Vehicle Costs

If you own a car in Panama, expect surprisingly low monthly running costs: gasoline runs about $0.55–$0.75 per liter and typical monthly fuel outlays are under $30, while car insurance averages roughly $58.32 a month.

Your overall vehicle costs stay reasonable — fuel and car insurance are the main fixed items, plus occasional maintenance and registration.

If you don’t drive, public transportation is very affordable: metro rides under $1 and buses $0.25–$0.35.

Uber services fill gaps with short trips typically costing $3–$4, useful for nights out or luggage.

When budgeting, separate transportation from utilities (electricity, water, gas), since those household bills fluctuate with AC use.

This split helps you track monthly gas expenses versus broader living costs.

Utilities and Household Bills

One clear way to budget in Panama is to split transportation from household utilities, since combined monthly utility bills (electricity, water, gas) usually run $50–$100 but can spike—homes without AC often pay around $30 for electricity, while heavy AC use can push bills near $300.

You’ll find water is cheap, typically $10–$30/month, and gas for cooking adds little to household expenses.

Factor in transport separately: metro rides run $0.10–$1.50, Uber about $3–$4, and gasoline $0.55–$0.75 per liter if you drive.

Monitor air conditioning use to control electricity. Track utilities as fixed monthly cost and adjust habits or appliance choices to keep overall expenses predictable and low.

- Track electricity daily

- Limit AC runtime

- Check water leaks

- Buy efficient appliances

- Budget for seasonal spikes

Healthcare and Insurance Expenses

You’ll find both public and private healthcare options in Panama, with public services offering very low-cost or nominal-fee care and private clinics providing faster appointments and wider specialist access.

Individual health insurance typically runs under $200 per month for those under 64, and you can compare policies by what they cover and copays.

Typical prices are much lower than in the U.S.—doctor visits from about $20, common lab panels around $170 for 16 tests, and dental work like crowns near $700.

Public vs. Private Care

Although Panama’s public system offers very low-cost or nominal-fee care, many expats choose private plans because they deliver faster access and broader services; you’ll find a clear tradeoff between cost and convenience.

Health insurance can be affordable — individual plans often run under $200/month, and Panama-only private health insurance may start at $30–40/month while international options exceed $300.

Doctor’s visits can start at $20; public fees sometimes hit $2–5. Labs are cheaper too: 16 blood tests ≈ $170 (vs. $1,257 in the U.S.) with next-day results.

Dental care is accessible, with free initial evaluations and crowns around $700.

Consider needs, travel, and whether you want extensive private services or low-cost public coverage.

- Compare monthly premiums and coverage levels

- Check wait times for specialists

- Verify lab turnaround times

- Include dental care in your plan

- Factor travel and emergency evacuation services

Insurance Cost Breakdown

Because health needs and travel plans vary, your insurance bill in Panama can range from pocket change to several hundred dollars a month.

You can find health insurance under $200 monthly for individuals under 64, and basic private health insurance that covers only Panama may run about $30–$40 per month.

International plans including U.S. coverage often exceed $300 monthly cost.

Out-of-pocket healthcare expenses are low: a doctor’s visit can start at $20, and some services cost $2–$5.

Diagnostic pricing is also cheaper—16 blood tests for $170 versus $1,257 in the U.S.

When planning, compare premiums, deductibles, network access, and whether you need international coverage to estimate true insurance cost and budget accurately.

Typical Treatment Prices

How much will routine care and common treatments set you back in Panama? You’ll find healthcare affordable compared with the U.S.: doctor’s visits can start at $20, with some services $2–$5, and many labs email 16 blood-test results for about $170 versus $1,257 in the U.S.

Private health insurance plans limited to Panama can run $30–$40/month; broader international plans exceed $300/month. Health insurance under age 64 often stays under $200/month, making coverage realistic for expats in Panama.

- Basic doctor’s visits: ~$20

- Blood panels (16 tests): ~$170, rapid e-mail results

- Dental care: free initial eval, crowns ~$700, fillings ~$100

- Private health insurance: $30–$40/month (Panama-only)

- Routine affordability rivaling monthly grocery budgets

Sample Monthly Budgets by Lifestyle and Location

1 simple way to understand living costs in Panama is to compare concrete monthly budgets by lifestyle and location.

You’ll see cost and living patterns clearly: a retired couple in Panama City spends about $1,966 per person monthly including housing and basics, while a single man on a Boquete farm lives on roughly $735 per month, illustrating how rural living can be more affordable.

An off-grid couple in Bocas del Toro manages about $410 per person monthly, the low end for minimal infrastructure lifestyles.

A family of five in Veracruz faces a $1,600 monthly mortgage plus roughly $600 for life insurance and private school fees, showing education and housing drive costs up.

Overall, a comfortable monthly budget for a single person typically ranges $1,200–$3,000, depending on location, housing preferences, and lifestyle choices.

Use these real examples to map your expected expenses and choose the balance of comfort versus affordability that fits you.

Taxes, Residency, and Pensionado Benefits

When you’re weighing a move to Panama, taxes and residency rules can make a big financial difference: the country taxes only income earned inside its borders, so foreign-earned income is generally tax-free, and property taxes are low (starting at 1.75% for valuations above $30,000, with exemptions below that).

You’ll find a territorial tax system that gives expats lower tax burdens compared with many countries, and property tax stays modest.

Residency options like the Friendly Nations Visa let qualifying applicants obtain permanent residency with minimal investment.

If you’re retiring, the Pensionado program offers tangible benefits: discounts on utilities (about 25%) and up to 50% off entertainment, helping stretch retirement income.

- Territorial tax system means foreign income is generally tax-free

- Property tax starts at 1.75% above $30,000; smaller properties often exempt

- Friendly Nations Visa offers straightforward residency pathways

- Pensionado delivers utility and entertainment discounts

- Expats typically enjoy lower overall tax burdens and documented benefits

Tips to Lower Your Cost of Living in Panama

Now that you know how taxes, residency, and Pensionado perks can cut expenses, you can take concrete steps to lower everyday costs in Panama.

To save immediately, buy local produce—groceries for one person can be as low as $95 monthly when you avoid imports. Use public transportation like Metrobus or budget Uber rides to keep transport under $30 a month rather than paying car ownership costs.

Choose housing outside Panama City; one-bedroom apartments start around $300/month, which lowers overall spending. For food, favor affordable dining at small comedores where meals run $5–$10 instead of upscale restaurants.

Reduce bills with energy-efficient habits and limited AC to achieve lower utility costs—expect $50–$100 monthly for electricity, water, and gas combined.

Track your budget against the average cost of living, prioritize high-impact changes (rent, groceries, transport), and monitor savings monthly to measure progress and adjust choices that maximize your disposable income.

Frequently Asked Questions

Can US Citizens Live in Panama?

Yes — you can live in Panama. You’ll apply for visas like the Friendly Nations Visa, secure residency, and budget roughly $1,500–$3,000 monthly depending on lifestyle; healthcare and US-dollar use simplify your changeover.

How Much Money Is Needed to Retire in Panama?

You’ll need roughly $1,200–$2,600 monthly; juxtaposing modest daily costs with affordable real estate, you’ll find condos from $160,000 and homes near $80,000, plus low healthcare and Pensionado discounts that stretch retirement income.

Can I Live on $1500 a Month in Panama?

Yes — you can live on $1,500 monthly in Panama if you choose affordable housing, shop local, use public transit, and limit AC. Typical costs: rent $600–$1,000, groceries $200–$350, utilities $50–$100.

Is Panama a Good Place for US Citizens to Retire?

Yes — you’ll find Panama ideal: coincidentally, its dollar currency, low healthcare costs (doctor visits ~$20, insurance <$200), pensionado discounts, affordable housing ($95k–$160k) and comfortable living under $2,600/month make retirement practical.

Conclusion

Living in Panama can feel like striking gold — rent, food, transport, and healthcare often cost far less than in North America or Europe, yet quality stays high. With smart choices (local markets, public transit, Pensionado discounts), you could live like a king on a budget or upscale without breaking the bank. Use the sample budgets, compare cities, and shop the numbers — you’ll likely save enough to retire earlier than you thought.