You can live comfortably in Nicaragua for about $1,000–$2,500 a month as a couple (singles often stay under $1,000) because rents, groceries, and services run 50–70% cheaper than in the U.S. One-bed rentals commonly cost $300–$400, utilities $50–$75, internet about $40, and local meals around $3. Healthcare and private insurance are far cheaper too, and property prices often sit under $100,000 — keep going to see detailed cost breakdowns.

Monthly Budget Breakdown for Couples and Singles

If you’re budgeting for life in Nicaragua, expect clear savings compared with the U.S.: a couple can live comfortably on $1,000–$2,500 per month depending on housing and lifestyle, while a single person can usually keep costs under $1,000.

You’ll see the Cost of Living break down into predictable categories: groceries, utilities, and dining. For couples, monthly cost for groceries typically stays under $300; as a single expat you’ll usually spend $75–$100.

Utilities — electricity and water — generally run $50–$75 monthly, so you won’t face large bills. Eating out is economical: a complete meal in local markets costs about $3, letting you balance home cooking and convenience without inflating your budget.

Utilities are modest—about $50–$75 monthly—and local market meals run roughly $3, keeping everyday costs low.

Compare these figures to U.S. averages and you’ll spot 50–70% savings in everyday expenses. Use these data points to model conservative and comfortable budgets and adjust for personal tastes and discretionary spending.

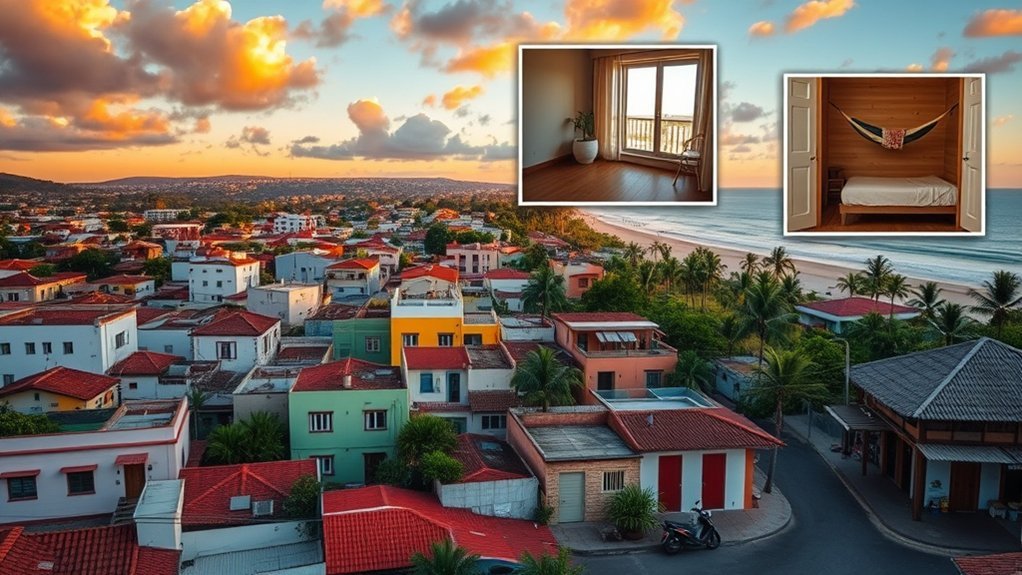

Housing and Rental Prices by Region

Having outlined monthly living costs, you’ll next look at housing, where Nicaragua delivers some of the biggest savings compared with the U.S. You’ll find one-bedroom furnished houses commonly rent for $300–$400/month; higher-end ocean-view rentals climb to $800–$1,000.

Two-bedroom ocean-view condos average about $500/month, a fraction of comparable U.S. coastal rents.

Region matters: beachside communities like San Juan del Sur and Tola offer competitive rental prices with both long- and short-term options, so you can balance lifestyle and budget. A three-bedroom, two-bath house averages roughly $280/month nationwide versus about $1,900 in California, illustrating the scale of savings.

If you’re considering buying, modest ocean-view homes and condos often list under $100,000; bargain ocean-view properties range $150,000–$260,000.

Use these benchmarks to compare neighborhoods, factor transportation and amenities, and decide whether renting or buying delivers the best value for your situation.

Utilities, Internet, and Communication Costs

Utilities and communications in Nicaragua are noticeably cheaper than in the U.S., with typical monthly water and electricity bills running $45–$75 versus U.S. bills that can top $350.

Utilities and communications in Nicaragua cost far less than the U.S., with combined water and electricity typically $45–$75.

Electricity alone can swing from $20 to $200 depending on home size and usage, while water generally falls between $20 and $50 (private wells cut costs further).

You’ll find utilities, internet, and costs to live here are predictable and lower overall. Internet plans average $40–$45/month for reliable service, though peak bandwidth lags behind major U.S. metros.

Cell service for two people typically totals about $60/month versus roughly $120 in California.

- Electricity: $20–$200/month — big variance based on AC and appliance use.

- Water: $20–$50/month — wells reduce recurring fees for homeowners.

- Internet & cell: $40–$45 for broadband; ~$60 for two mobile lines.

Plan budgets conservatively around $80–$130/month for combined basic utilities and internet; adjust upward if you run heavy air conditioning or stream extensively.

Grocery and Dining Expenses

After you handle monthly bills and connectivity, food costs quickly become one of the next biggest line items. For grocery planning, expect a single person to spend $75–$100 monthly; a couple typically stays under $300, and a family of four usually spends $200–$400 depending on diet and shopping habits.

That makes groceries in Nicaragua particularly cheaper than in many North American or European cities. For dining out, local markets offer full meals for about $3, while freshly caught red snapper runs roughly $3 — seafood is an affordable option.

Restaurant beer at $1–$1.25 further reduces dining expenses when you eat out occasionally. You’ll save most by combining local markets and occasional restaurants: buy staples and produce at mercados, then enjoy inexpensive prepared meals for variety.

Track weekly spend to stay within budget, and adjust habits (more market shopping, fewer imported items) to optimize grocery and dining expenses without sacrificing quality.

Transportation and Vehicle Ownership Costs

If you drive regularly, expect to pay about $45–$80 monthly for fuel in Nicaragua, with basic car insurance adding roughly $15 a month and maintenance and occasional repairs as extra variables. These costs, along with generally lower registration and taxes than in the U.S., make vehicle ownership especially cheaper here.

You’ll find transportation costs lower overall than in many North American cities. Fuel and reduced registration/tax rates cut recurring expenses; maintenance can vary by vehicle age and where you service it.

If you don’t want a car, in-town taxi fares are inexpensive and practical for short trips, while buses offer the cheapest option for daily travel.

- Fuel: $45–$80/mo depending on use.

- Insurance & registration: ~$15/mo for basic insurance; lower taxes vs. U.S.

- Local transit: taxis $1–$2 short rides; buses much cheaper.

Compare your expected mileage and convenience needs to decide between vehicle ownership or relying on taxis and public transit.

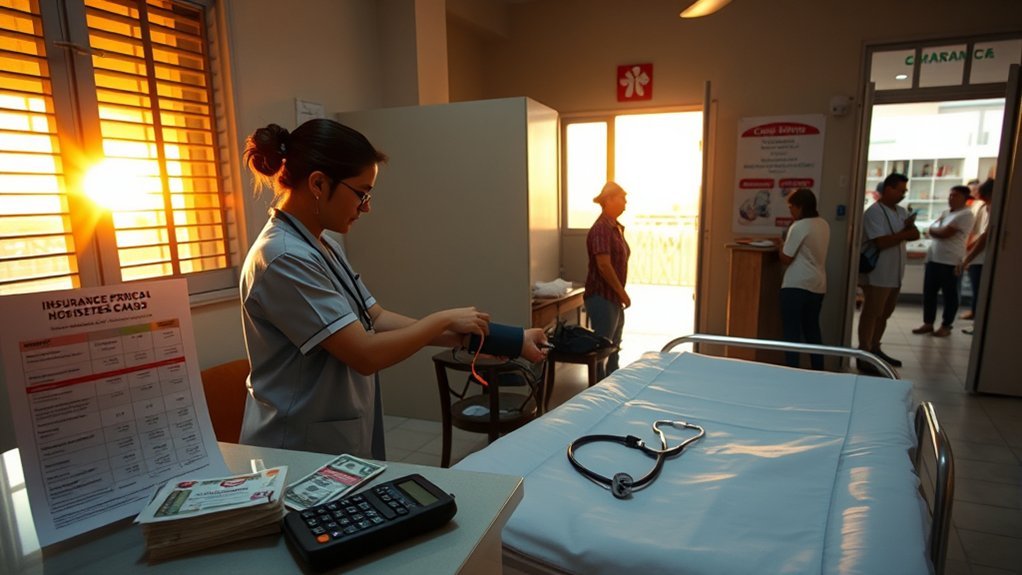

Healthcare, Insurance, and Medical Services

While public healthcare exists, most expats opt for private plans—typically about $100 per month for good coverage—because private clinics offer faster service, more consistent quality, and much lower out-of-pocket fees than you’d expect in the U.S.

Most expats choose private plans—about $100/month—for faster, more reliable care and much lower out-of-pocket costs.

You’ll find private health insurance in Nicaragua is affordable relative to U.S. premiums, and it dramatically reduces your exposure to unexpected bills. Routine doctor visits, basic diagnostics, and common medications cost a fraction of U.S. prices; many expats buy prescriptions at local pharmacies to cut costs further.

Emergency medical services and hospital care are available, but coverage should include international medical evacuation for severe cases, since high-acuity treatment may require transfer.

Compare plan deductibles, network hospitals, and evacuation limits to quantify risk. Expect lower out-of-pocket costs for most medical services, but budget for occasional specialist care or imaging that might be pricier.

In short, with a ~$100/month plan plus modest co-pays, you’ll secure reliable medical services at much lower total cost.

Entertainment, Leisure, and Local Services

Healthcare costs in Nicaragua are lower than in many Western countries, and you’ll find the same cost advantages extend to entertainment and local services.

You can regularly enjoy live entertainment at venues with no cover charge, and drinks like beer or rum average about $1.50, making nights out inexpensive compared with North American or European cities.

Outdoor leisure — fishing, horseback riding — is available at modest rates, and classes (painting, yoga) typically run ≤ $10, offering low-cost enrichment.

- Live music & bars: many venues no cover; drinks ≈ $1.50.

- Outdoor & classes: fishing, riding, painting, yoga — low per-activity fees ≤ $10.

- Household support: full-time domestic help starts ≈ $233/month.

You’ll find local markets are affordable for weekly shopping, further lowering living costs.

Comparing alternatives, routine leisure and basic services stay budget-friendly, so you can allocate more of your budget to travel or savings while maintaining a comfortable lifestyle.

Property Purchase, Financing, and Taxes

You’ll find purchase prices rising near new infrastructure, with modest homes and condos under $100,000 and ocean-view homes commonly between $150,000–$260,000.

Use financing tools like an Owner Financing Calculator to compare monthly payments and assess affordability versus renting (ocean-view two-bedroom rentals average about $500/month, higher-end homes can exceed $2,000).

Expect low annual property taxes around 1% of assessed value and monthly management fees typically between $150–$300, which you should factor into total carrying costs.

Purchase Prices & Trends

Because new infrastructure projects are pushing demand, property prices in Nicaragua have been rising.

Yet modest homes and condos still sell for under $100,000 while ocean‑view houses commonly range from $150,000 to $260,000.

You’ll find real estate that’s affordable compared with many neighboring countries, and lower ongoing bills and taxes improve total cost of ownership.

Property tax averages about 1% of value; monthly rental or management costs typically run $150–$300, useful benchmarks if you plan to rent out a purchase.

Use local market comps to compare neighborhoods and gauge appreciation potential.

- Compare: modest < $100k vs. ocean‑view $150–$260k.

- Carrying costs: bills + management $150–$300/month.

- Taxes: ~1% annual property tax.

Financing Options Explained

When evaluating property purchase in Nicaragua, compare owner-financing offers, bank loans, and cash purchases side-by-side so you can quantify monthly outflows, upfront costs, and tax implications.

Owner financing often lets you negotiate down payment, term, and interest directly with sellers; use an Owner Financing Calculator to model scenarios and monthly affordability.

Bank loans may mimic U.S. structures less often and can be more restrictive, but sometimes offer competitive rates for residents.

Cash purchases eliminate interest expense and simplify closing, though they require capital.

Factor in ongoing property management costs of $150–$300/month into total carrying cost comparisons.

Property Taxes & Fees

After comparing financing routes, you should quantify the recurring and one-time taxes and fees that change the true cost of ownership in Nicaragua.

You’ll pay relatively low property taxes — about 1% annually of assessed value, with a $10 minimum — but that’s just the baseline. Factor in closing and transactional costs for real estate purchases and legal compliance.

- Notary & closing: 1–2% of purchase price for notarization and administrative fees.

- Ongoing: ~1% annual property taxes plus $150–$300/month for property management/upkeep if you outsource.

- Financing/legal: owner financing may reduce upfront cash needs, but budget for a local attorney to handle due diligence and title work.

Compare scenarios (cash vs owner-financed) to see net effective cost.

Frequently Asked Questions

How Much Is the Average Rent in Nicaragua?

The average rent in Nicaragua is about $300–$400 per month for a furnished one-bedroom; you’ll find cheaper regional three-bed options (~$280) and higher-end or ocean-view units ranging $500–$1,000 depending on location and amenities.

Can Americans Live in Nicaragua?

Yes — you can live in Nicaragua; like bygone sailors comparing ports, you’ll find Americans often thrive on $1,200–1,500 monthly, with cheap rent ($300–$400), low utilities ($50–$75), and affordable groceries under $300.

How Much Do You Need to Live Comfortably in Nicaragua?

You’ll need about $1,500 monthly as a couple or $1,200 solo to live comfortably; rent’s $300–$400, groceries $100–$300, utilities $50–$75, and internet plus dining keep overall costs well below U.S. averages.

Can a US Citizen Buy a House in Nicaragua?

Yes — you can. About 30% of modest homes sell under $100,000, so you’ll often pay less than U.S. prices. Hire a local attorney, compare listings, and consider owner financing to spread payments practically.

Conclusion

In Nicaragua you can live like a king on a budget or like a miser on a mansion — it all hinges on choices. Compared to many Western countries, rent, groceries, and private healthcare are dramatically cheaper; transport and utilities vary by region. Use the data: choose Granada or San Juan del Sur for tourist prices, León or inland towns for savings. Practical tip: balance location and lifestyle to hit your target monthly budget.