Wondering how much a tax lawyer costs? The answer varies widely.

Hiring a tax lawyer can be crucial for handling complex tax issues. Costs can range from a few hundred to several thousand dollars. Factors like the lawyer’s experience, your location, and the complexity of your case influence the price. Understanding these costs can help you budget and make an informed decision.

This guide will break down the factors affecting tax lawyer fees, helping you get a clearer picture of what to expect. Whether you’re dealing with an audit, need advice, or facing legal issues, knowing the costs upfront can ease your stress. Dive in to learn more about hiring a tax lawyer and the expenses involved.

“An experienced tax attorney may seem expensive, but the cost of avoiding penalties or reducing tax debt is worth it.” – Sarah Lee, Tax Law Specialist

Introduction To Tax Lawyer Costs

Understanding the cost of hiring a tax lawyer is important. Many people need help with tax issues. But they worry about the expense. This section will help you learn about tax lawyer costs.

Importance Of Tax Lawyers

Tax lawyers help with complex tax issues. They provide legal advice and represent clients in court. They also help with tax planning and disputes with the IRS. Their expertise can save you money and stress.

Factors Influencing Costs

Several factors affect the cost of a tax lawyer. Experience is one factor. More experienced lawyers often charge more. The complexity of your tax issue also influences cost. Simple issues cost less than complex ones.

Location is another factor. Lawyers in big cities may charge more. The lawyer’s reputation can also affect costs. Well-known lawyers often have higher fees.

Hourly rates and flat fees are common billing methods. Hourly rates vary widely. Many tax attorneys charge between $200 and $600+ per hour. Flat fees depend on the service provided. Always discuss fees upfront to avoid surprises.

Hourly Rates

When hiring a tax lawyer, understanding their hourly rates is crucial. Hourly rates can differ based on various factors. Knowing these can help you budget effectively and avoid surprises.

Average Hourly Fees

The average hourly rate for a tax lawyer can vary widely. Generally, rates range from $200 to $600+ per hour. Some experienced lawyers may charge even more.

| Experience Level | Hourly Rate |

|---|---|

| Junior Lawyer | $200 – $300 |

| Mid-Level Lawyer | $300 – $450 |

| Senior Lawyer | $450 – $600+ |

Factors Affecting Hourly Rates

Several factors can influence a tax lawyer’s hourly rate:

- Experience: More experienced lawyers charge higher rates.

- Location: Lawyers in big cities tend to charge more.

- Complexity of Case: Complex cases require more expertise and time.

- Reputation: Lawyers with a strong reputation may have higher fees.

Understanding these factors can help you choose the right lawyer for your needs. Make sure to discuss rates upfront to avoid any misunderstandings.

Flat fees provide clarity and help clients budget for legal expenses, especially for predictable tasks like filing appeals.” – Mark Evans, Legal Consultant

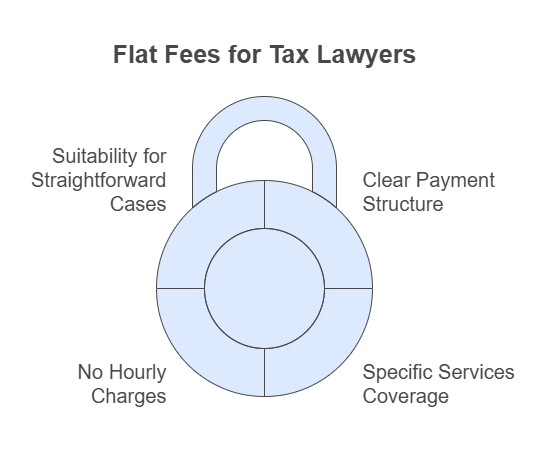

Flat Fees

Understanding how much a tax lawyer costs can be tricky. Flat fees provide a clear payment structure. These fees cover specific services without hourly charges. This payment option often suits straightforward cases.

Common Flat Fee Services

Flat fees cover various tax lawyer services. Common services include tax return preparation, filing for tax extensions, and handling simple audits. Lawyers also charge flat fees for drafting legal documents. This might involve creating tax plans or settling minor disputes.

Advantages Of Flat Fees

Flat fees offer several benefits. First, they provide cost certainty. You know the total expense upfront. This helps in budgeting. Second, flat fees often mean faster service. Lawyers complete tasks quickly without tracking hours. Finally, flat fees reduce stress. No worries about rising costs with each phone call or email.

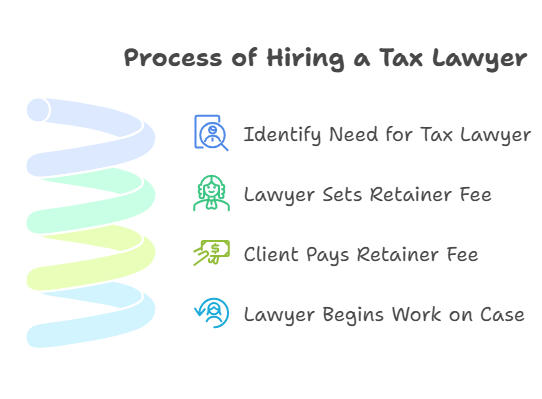

Retainer Fees

Understanding the costs of hiring a tax lawyer can seem complex. One important aspect to consider is retainer fees. These fees are upfront payments that lawyers require before starting work on your case. Retainer fees can vary, but they provide a way for lawyers to secure payment for their services.

Understanding Retainers

Retainers act as a guarantee. They ensure lawyers get paid for their work. This fee is usually a deposit. It goes into a special account. Unearned funds are typically held in a client trust/IOLTA account and applied to your invoices as work is performed; unused balances are usually refundable. Retainers can be refundable or non-refundable. Refundable retainers mean any unused funds are returned to you. Non-refundable retainers mean the lawyer keeps the entire fee.

Retainer Fee Structures

Retainer fee structures can differ. Some lawyers charge a flat retainer fee. This means you pay one set amount upfront. Other lawyers use an hourly rate retainer. Here, you pay based on the hours the lawyer works. There is also a mixed retainer. This includes a flat fee with hourly charges after a certain number of hours.

Understanding these fee structures is crucial. It helps you budget for your legal expenses. Always ask your lawyer to explain their retainer fee structure. This ensures you know what to expect.

“The more complex your case, the more time and expertise it requires. Preparation is key to reducing legal fees.” – James Carter, Tax Attorney

Contingency Fees

Important: In tax matters, contingency fees are tightly restricted under IRS Circular 230 §10.27. They are generally not allowed for most services before the IRS. Where permitted (for example, certain refund claims, work connected to an IRS examination, or judicial proceedings), the lawyer may take a percentage of the recovery.

When Contingency Fees Apply

Contingency fees apply only in limited situations where a monetary recovery is expected and allowed by ethics rules—such as certain tax refunds or court recoveries. For most IRS-facing services (like return preparation), contingency fees are not permitted. Where they are allowed, the fee is often around 20%–40% of the recovered amount.

Pros And Cons

Note: The following pros and cons apply only where a contingency is permitted.

Pros:

- No upfront costs for the client.

- A lawyer is motivated to win the case.

- Accessible for clients with limited funds.

Cons:

- High percentage of recovery goes to the lawyer.

- If the case is lost, the lawyer gets nothing.

- Clients might end up paying more in successful cases.

Understanding the pros and cons helps you make an informed decision. Make sure to review the contingency fee agreement carefully.

Additional Costs

Hiring a tax lawyer involves more than just the hourly rate. Additional costs can vary based on several factors. Understanding these costs can help you budget more effectively. Let’s break down some of these expenses.

Consultation Fees

Many tax lawyers charge a consultation fee for the first meeting. This fee can range from $100 to $500. During this session, the lawyer assesses your case and provides initial advice.

Sometimes, this fee is waived if you hire a lawyer. Always ask about this upfront. Understanding this helps you plan better.

Other Potential Expenses

There are various other costs to consider:

- Filing Fees: Legal paperwork often requires filing fees. These can add up.

- Expert Witnesses: If your case requires expert testimony, this can be costly.

- Travel Expenses: If your lawyer needs to travel for your case, you may cover these costs.

- Administrative Costs: Printing, copying, and mailing documents can also add to your bill.

- IRS User Fees: For example, an Offer in Compromise requires a $205 application fee (waived for qualifying low-income applicants).

Always ask for a detailed estimate. This helps avoid surprises and keeps you informed.

“Tax lawyers help you navigate tricky situations that could cost you thousands if handled incorrectly.” – John Doe, Tax Attorney

Cost-saving Tips

Hiring a tax lawyer can be expensive. To keep costs down, consider some practical tips. Understanding these tips can help you get the best value for your money.

Comparing Lawyers

Research different lawyers and their rates. Not all lawyers charge the same fees. Create a list of potential lawyers and compare their prices.

- Check their experience and qualifications.

- Read reviews and testimonials.

- Ask for references.

Comparing lawyers allows you to find one that fits your budget.

Negotiating Fees

Do not hesitate to negotiate fees. Many lawyers are open to discussion.

- Ask if they offer a flat fee.

- Inquire about payment plans.

- Request a discount for upfront payment.

Negotiating fees can significantly reduce your costs.

Frequently Asked Questions

What Is The Average Cost Of A Tax Lawyer?

The average cost of a tax lawyer can vary widely. Typically, rates range from $200 to $600+ per hour. Factors like experience, location, and complexity of the case affect the cost.

Do Tax Lawyers Charge A Flat Fee?

Some tax lawyers may charge a flat fee for specific services. However, many charge by the hour, especially for ongoing or complex cases.

Are Tax Lawyer Fees Tax-deductible?

Business-related legal fees are generally deductible. Most personal legal fees are not deductible for 2018–2025 under the TCJA, with limited exceptions. Always confirm with your tax professional.

How Can I Find An Affordable Tax Lawyer?

To find an affordable tax lawyer, compare rates from multiple lawyers. Look for those who offer free consultations and discuss payment plans.

Conclusion

Understanding tax lawyer costs helps you plan your budget wisely. Fees vary based on experience, location, and case complexity. Always compare rates before choosing. Legal expenses may seem high but can save you money long-term. Hiring a tax lawyer ensures expert handling of your tax issues.

Protect your assets and avoid costly mistakes. Make an informed decision by researching and asking questions. Proper guidance from a tax lawyer is invaluable. Prioritize your financial future by investing in professional help.